Geodemographics - blogs and resources

Visit the Geodemographics Knowledge Base (GKB) for expert blogs and links to useful sources of geodemographic data and knowledge.

The MRS Census and GeoDems group champions new thinking and new talent; one area they have been particularly impressed with is the CDRC Masters Dissertation Scheme (MDS)

This programme offers an exciting opportunity to link students on Masters courses with leading retail companies on projects which are important to the retail industry. The scheme provides the opportunity to work directly with an industrial partner and to link students’ research to important retail and ‘open data’ sources. The project titles are devised by retailers and are open to students from a wide range of disciplines.

MRS CGG are proud to have been granted permission to publish abstracts from the dissertations and we are sure the students have a great future ahead of them.

This abstract is by Nicolo Coelewij

Title: Drivers of the Warehousing Market: Understanding How Structural Changes in Freight Transport, Ecommerce and Manufacturing Industries Are Driving the Growth in Warehousing Markets

Academic Institution: University College London

Industry Sponsor: Barbour ABI

Background and Motivation

Warehouses have become a highly sought out asset, outpacing most other types of property in terms of value and rental growth. Warehousing markets have also outperformed levels of economic growth in the UK, suggesting the market is driven by forces greater than the business cycle. Research has shown that warehouses are mainly occupied by freight transportation, ecommerce and manufacturing industries, indicating that the warehouse market is largely dependent on these key industries. Furthermore, these industries are going through structural changes which have transformed the way they utilise warehouses and where they locate them. In freight transport industries, structural changes are related to creating faster and more sustainable freight networks which can be integrated with various modes of transport. Increased competition in ecommerce is driving the development of new, more efficient delivery systems, enabling next day deliveries. Finally, manufacturing is experiencing a form of renaissance, with an increased focus on research and development (R&D) and education.

This dissertation investigates how structural changes in the aforementioned industries are fundamentally driving the growth of warehouse markets. This study highlights the importance of understanding mechanisms of the warehouse market and to be able to interpret how future trends will drive prospective warehouse developments.

Data and Methods

This dissertation is sponsored by Barbour ABI, who have provided their Comprehensive Project Database (CPD) The CPD is an Excel document with data on over 35,000 warehouses, built or speculative, in England from 2000 to 2023. These data include locations, values, sizes, schemes, clients, developers and more. Further primary data are sourced from the Office for National Statistics (ONS), the Departments for Transport (DfT), other publicly available statistics, CoStar, corporate annual reports and reports from real estate consultants such as Savills and Colliers. Studying industry data results in the identification of one main case study in which structural change to the industry is occurring. Two other cases are then identified to carry out a comparative analysis against other socio-economic environments.

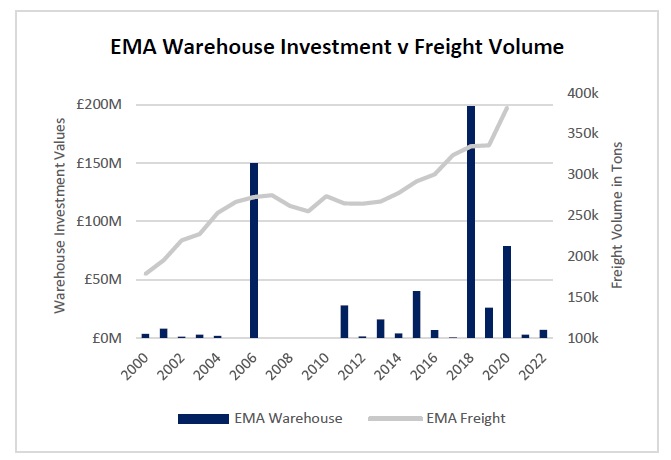

Once case studies have been identified, warehousing developments are sourced through the CPD by entering the post-codes of the case study area. A quantitative analysis is then carried investigating how structural changes impact total warehouse developments in terms of total investment value, average value, warehousing sizes and total area. The result is a time-series graph which associates how warehouses developments are impacted by these structural changes.

Key Findings

Intermodal freight terminals, such as the East Midlands Airport and London Gateway, are attracting huge demand for warehousing space. From 2010 – 2022, the EMA attracted 227% more warehouse investments than Stansted while the London Ports attracted 539% more warehouse investments than Felixstowe. This is because freight transporters are attracted to the fast, sustainable and flexible services of multimodal hubs and are likely to develop massive warehouse at close proximities to them. As airfreight becomes more valuable and the containerization increases in popularity, airports and seaports are becoming popular locations for warehouse investments. Train freight will also increase in popularity as it is the most environmentally sustainable mode of transport.

In ecommerce, structural changes are caused by new developments to the delivery network. Today, networks are evolving towards regional fulfilment rather than national. This has led to an increase in warehouse developments in more isolated regions. For example, from 2016 – 2020, the South-West (SW) experienced a 201% increase in warehouse investments compared to five years prior. In this period, the SW also overtook the Golden Triangle in total warehouse investment volume. An investigation into median values and interquartile ranges also indicates that the popularity of regional fulfilment centres is increasing. Improving the last mile has also led to a surge in warehouse developments in city locations. Cities experiencing growth in the economy and population are more likely to attract last-mile facilities as they are more likely to drive higher sales volumes.

New warehouses are also being developed around newly formed industrial clusters to accommodate new manufacturing processes. Industrial clusters can cause ripple effects throughout their region, leading to the transition into more productive industries. This can be seen from Sheffield’s AMP, which caused a structural change in the cities manufacturing process. This led to huge demand for warehouse within the AMP and its surroundings. Different warehouses are also associated with different manufacturing sectors. In the SCR, every £1 spent on manufacturing warehouse requires £1.2 spent on storage facilities. Other manufacturing sectors, such as the chemicals industrial cluster in Teesside require much more specialized warehousing, composing 93.6% of all warehouses.

Value of Research

The investigation was successful in identifying structural changes in key warehouse-occupying industries. Through a case-by-case analysis, this dissertation has identified how these structural changes impact warehousing demand in various socio-economical regions. This allows readers to understand how prospective trends might impact the warehouse market and anticipate future developments. This study would additionally benefit from an investigation into the occurrence of these three industries developing simultaneously in one area.

Visit the Geodemographics Knowledge Base (GKB) for expert blogs and links to useful sources of geodemographic data and knowledge.

Our newsletters cover the latest MRS events, policy updates and research news.

0 comments