Geodemographics - blogs and resources

Visit the Geodemographics Knowledge Base (GKB) for expert blogs and links to useful sources of geodemographic data and knowledge.

The MRS Census and GeoDems group champions new thinking and new talent; one area they have been particularly impressed with is the CDRC Masters Dissertation Scheme (MDS)

This programme offers an exciting opportunity to link students on Masters courses with leading retail companies on projects which are important to the retail industry. The scheme provides the opportunity to work directly with an industrial partner and to link students’ research to important retail and ‘open data’ sources. The project titles are devised by retailers and are open to students from a wide range of disciplines.

MRS CGG are proud to have been granted permission to publish abstracts from the dissertations and we are sure the students have a great future ahead of them.

This abstract is by Dieyan Wang, titled Valuing the high street and modelling the impact of a change of policy and uses on the generation of place management and development funding

Academic Institution: University College London

Industry Sponsor: Institute of Place Management

Background and Motivation

The retail centre, a focal point for the UK economy and business, is experiencing a decline in the economy and being abandoned within customers' shopping preferences because of the rise of the Internet and the decentralization from urban to out-of-town shopping centres. Retrieving retail performance is now one of the critical priorities for the UK government's national and spatial planning by carrying out targeted policies and quantitative evidence bases. Although local authorities have determined the essential indicators of retail success and failure, the "Department of Business, Innovation, and Skills" realised that the records pertinent to non-retail sectors are rare and quantitative data related to the economic area is often unavailable. More necessarily, it is difficult to evaluate the post-effect of policy implementation on retail centre's vitality due to the lack of comparison with a same declined region that had nothing happened.

Data and Methods

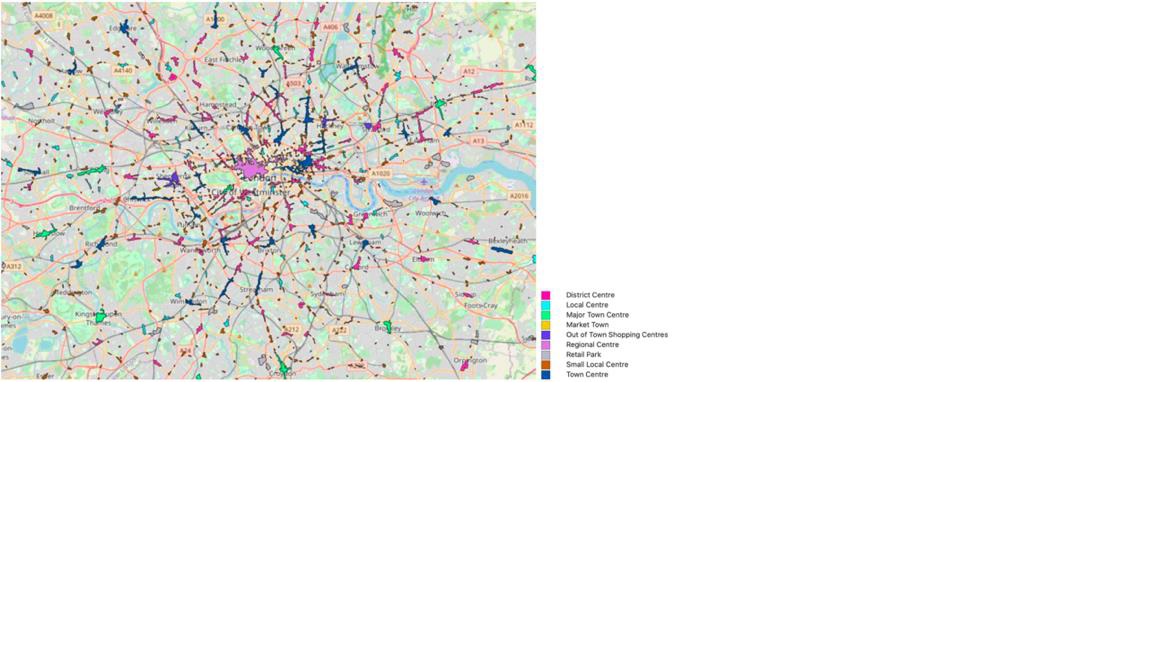

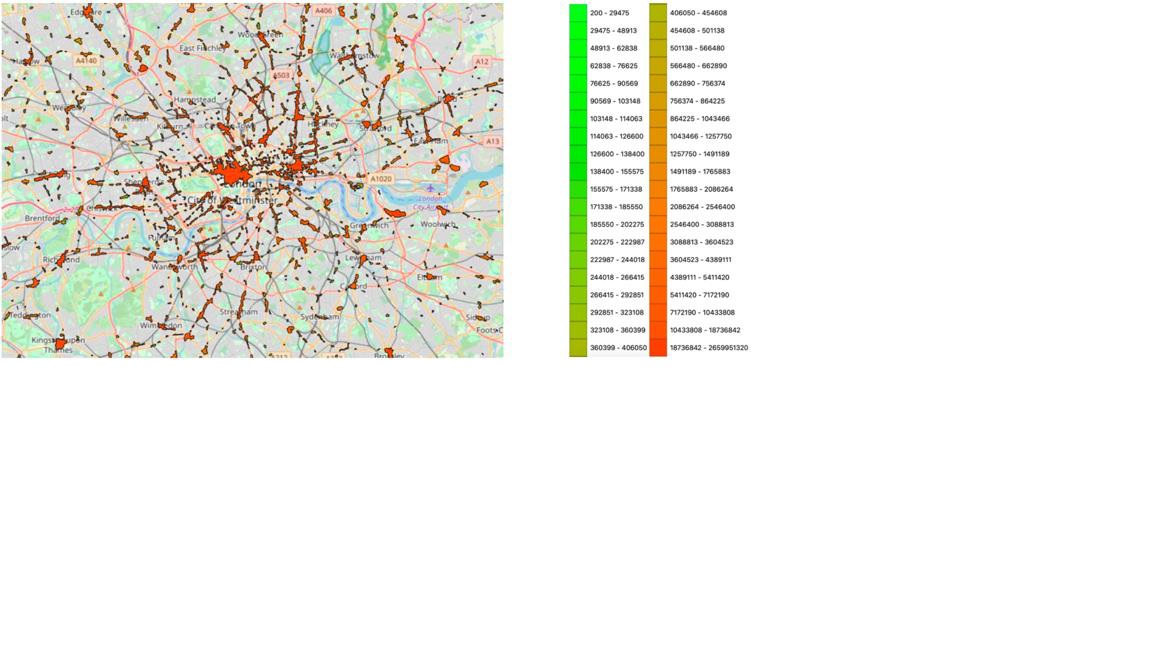

Our data can be divided into geographical and non-geographical databases. The non-geographical data includes the 2017 and 2010 rating list summary valuations in England and Wales, the population density and unemployment rate collected on the Digimap website, and the Business Improvement District Levy in February 2020 offered by the dissertation project company. Geographical dataset contains the latest retail centre boundaries published on Consumer Data Research Centre in 2019, 2020 London Business Improvement Districts produced by Greater London Authority, and boundaries of output area 2011 census. There are 6423 retail locations across the UK classified in 9 tiers and 70 London business improvement districts.

To reflect each property information on map, we firstly geocode the property postcode on Doogal Batch Geocoding to find the coordinates. Then, we import postcodes to the map layer in QGIS and overlap with the

layers of retail centre boundaries, London BID areas, and the output area to find how many properties fall in each location.

The valuation has two parts. The first section uses rateable value, an excellent proxy measurement of the missing financial variables, as the judgment standard to calculate the current value of retail centres. Next, K-means, a clustering algorithm, further categories each centre into different groups based on their rateable value, population density and unemployment, covering economic, demographic, and social aspects. Finally, XGBoost and random forest regressors will predict how much the focused policies can influence retail centres' vitality recovery. The selected policies are Business Rate Revaluation, BIDs Levy, and Permitted Development (change commercial area to residential). We only concentrate on retail centres position in England and Wales.

Key Findings

1. Valuation Section

In the top ten retail centres with the highest rateable values, 70% are in London, and the other three are Manchester City, Birmingham City, and Leeds City. Based on the valuation with multiple aspects in clustering, the development of retail centres can be roughly divided into three types – stable, potential, and retarded. 149 retail centres labelled clusters 2 and 4, which belong to stable group, have the best development with a tough economy and sufficient incomes for employees because the property values are above the average of £300-450 / ????????, and the low unemployment rate is controlled at 1.88% - 3.75%. The low population density indicates that there are not many residential areas, and most lands are used for commercial or business purposes.

3994 retail centres labelled clusters 0 and 1 are treated as potential locations that have medium rateable value, higher population density and greater unemployment rate. 1327 retail locations in Cluster 3 have retarded vitality with the lowest housing values, medium population density, and severe unemployment, occupying about one-fifth of the total retail centres. Take London, Birmingham, and Manchester as an example. No matter the type or size, most retail centres have a stable economy and high development potential in London. However, the District Centres in Birmingham, located in the urban area, are grouped in Cluster 3 and did not significantly contribute to economic contribution. Conversely, in Manchester, retail parks and the largest out of town centre have strong vitality in the economy.

2. Regression Section

"Adopted RV_2010" has positive effects on model output, so an increase in the value of these features will improve 2017 rateable value, and a decline will bring down. It confirms that a regular Business Rates Revaluation is feasible to fill the gaps in house rent if there is any change in old property values. Furthermore, the Business Improvement Districts Levy should prevent a dramatic increase in tax rate because the higher the tax payment, the lower the 2017 rateable value. Moreover, Permitted Development is not a good policy for the non-residential area of a property because a decline in floor space will reduce the 2017 rateable value. However, it is an excellent idea for the residential part if the retail or office waste area is transferred into living space. High house utilisation can reduce the redundant fee on non-residential maintenance such as machine inspection, shop utilities, and store environmental design.

Value of the research

This paper aims to explore new criteria, namely the effect of non-domestic properties' attributes, in the UK retail industry's performance judgment and intensify the use of machine learning and technical knowledge in place development and management. In addition, map intersection provides a more straightforward approach to link different geographical information in the same layer and strengthens the study of QGIS in real-life issues. Also, the research indicates the limitations in vitality recovery, targeted business strategies for different clusters, and future development opportunities for retail centres.

Figure 1: Type, Total Rateable Value and Cluster of Each Retail Centre in London

Visit the Geodemographics Knowledge Base (GKB) for expert blogs and links to useful sources of geodemographic data and knowledge.

Our newsletters cover the latest MRS events, policy updates and research news.

0 comments